The Nonfarm payrolls for last month is being announced in a couple of hours. Generally speaking, the nonfarm payrolls is one of the most anticipated trading events of the month for investors. But today might just be one of the biggest ones in history.

A lot of the numbers released over the last few weeks have been bad data. Unemployment is up, purchasing is down and uncertainty is at an all time high. With so many countries going into lock down the bad data was simply inevitable. Today we hear the number of jobs created (or lost) that excludes the agricultural sector for the US. This is an indicator that highlights the economy’s health and growth rate.

The biggest challenge that any economy faces right now is to survive the corona virus pandemic. With lock down in effect there’s only essential services permitted to operate. This cuts the demand down massively across multiple sectors. Look at what happened to the demand for oil as countries imposed lock down regulations. No one has been driving to work or non essential reasons, so the demand for fuel has disappeared overnight. What makes things worse is that as people are staying at home as companies close down. Jobs are being lost in the millions and buying power is being drained in the process. This paints a perfect picture for bad data when it comes to economic performance.

Why can today bring potentially the biggest nonfarm payrolls of 2020?

The job losses in March was considerable, but April is without the shadow of a doubt the worse economic period since the outbreak (and the spanish flu). We can all agree on that. With so many businesses forced to stop trading and spend weeks behind closed doors, there is very little activity remaining. The best performing sector in fact should be agricultural as it has to fully operate to keep feeding the country. Important for the people but not entirely helpful to the economy or a chance of recovery.

Refinitiv (a research company) recently completed a poll that indicated over 21 million job losses could be recorded. This is equivalent to the amount of jobs created since March 2010.

The nonfarm payrolls news will just be the initial shock. With job losses the buying power will evaporate as people change their spending habits and shift priorities to survival costs like food. Luxury and non essential industries are going to take a massive blow. Recent trend research revealed that big companies have placed a complete stop on investment plans for the future in response to the pandemic.

Can all these things that have happened over the last weeks cripple the US economy? You bet. Can this possibly be the worst nonfarm payrolls yet? Maybe it’s only the beginning…

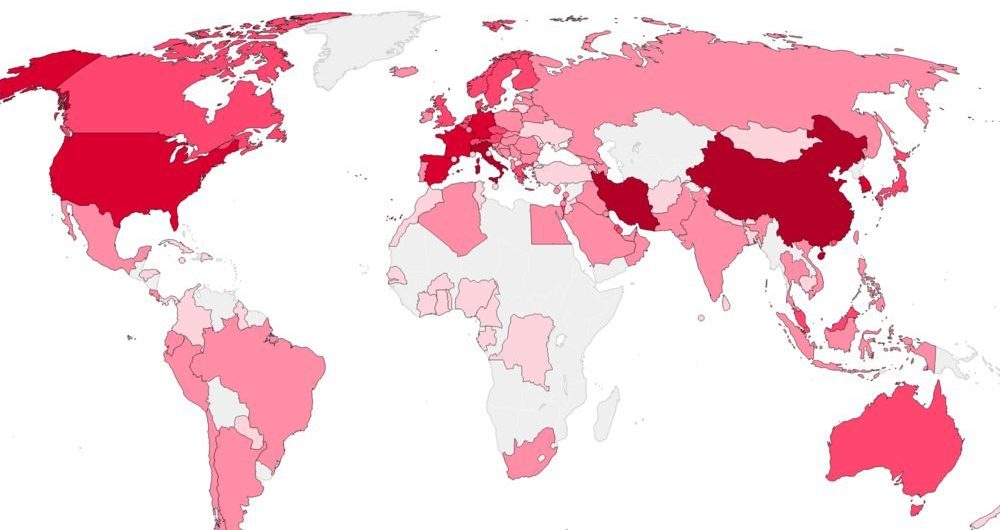

Yesterday I shared my view across a few charts with my clients and all the charts indicated one thing. A strong possibility for dollar weakness. My focus remains on technical analysis and I keep track of the news & events simply to stay informed. When we look at the heat map the effected areas are in dark red. Countries like the US, European countries and Australia are month the most affected.

My personal view is that the nonfarm payrolls numbers are likely to make the previous month’s figures look like a drop in the bucket. We are yet to see if this will be the reality but soon all will be revealed.

Thought of the day

While we all try to safeguard ourselves and our families during this crazy time, we should keep our communities in mind. We are donating to needy communities in our area to provide support to those that don’t have any. Every bit helps and we will never fully understand the needy’s gratitude. There is only one way out of this and that is together.

May the nonfarm payroll numbers be ever in your favor!

Vee