The engulfing bar candlestick pattern

The engulfing bar candlestick pattern is a very powerful “signal” from the market. It can be used to enter a trade at the right place and time.

Engulfing bars do exactly as the name suggests. It forms when a candlestick completely engulfs its preceding candle, notably in the opposite direction. For an engulfing bar to be valid it would have to engulf at least one of the previous candles. This candlestick pattern consists of two candles. The body of the first candlestick has to be bigger than the second, essentially engulfing the first candle.

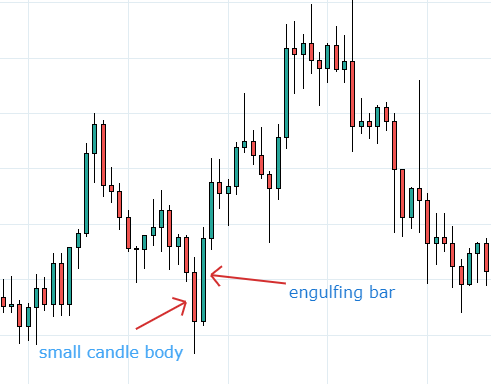

Here is an example:

Bullish engulfing bar

Naturally when we see green (bullish) candles, it means there are more buyers than sellers in the market. Vice versa would apply for a red (bearish) candlestick for that particular period. We look at these two candles collectively to get a better idea of exactly what is happening between the buyers and sellers in the market. A bullish engulfing bar indicates that buyers are in control and pushing the price higher. The chart above shows how the bears fail to drive price lower and are eventually overcome (engulfed) buy buyers.

A bullish engulfing bar can indicate a change in the market from a down trend to an up trend. The bears were in control up to the point where the engulfing bar formed. Then the he buyers took control of the market.

Important note. Do not trade the engulfing bar independently. Rather at specific turning points in the market that have to be confirmed through technical analysis.

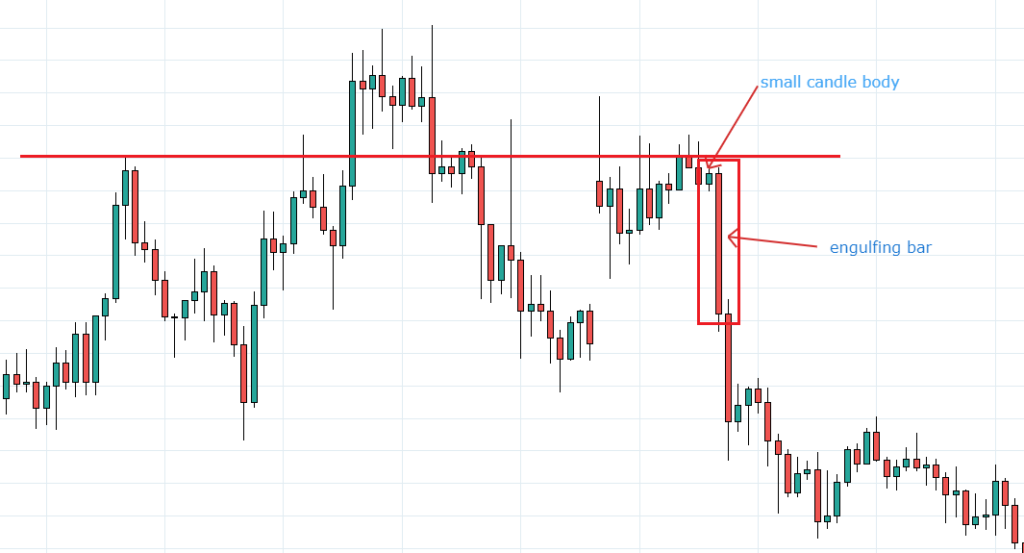

Bearish engulfing bar

From the chart above it is clear that the resistance level was holding while the buyers had difficulty breaking higher. The large red bar is the engulfing bar (bearish) signalling that the sellers have taken control of the market. Mid trend a bearish engulfing bar signals trend continuation. Contrary to the latter, a bearish engulfing bar at the end of a trend signals the very strong possibility of a trend reversal.

It is not advisable to trade the engulfing bar randomly. Use it subjectively in accordance with technical analysis and other tools. The video below will explain exactly how to trade the engulfing bar in various market conditions and all the factors that need to be considered.

The engulfing bar is just one piece of the price action puzzle. There is more information like this on price action trading that you should know in order to become a good price action trader. You can read more about price action and what it can do for you and your trading HERE. Or you can click on the button below to learn more